Blog written by Steve Raw, Managing Director of Dosh

Sitting in the car park of the venue for today’s Money Awareness Training waiting for the caretaker to arrive, I am thinking about who I will meet and how the workshop will pan out during the course of the day. It is the feeling of excitement I always experience and is similar to the one I had a couple of weeks ago when I arrived for the training I would be delivering with a colleague in the Scottish Borders.

Whilst this is not my main employment (I am/have been the Managing Director of Dosh* since 2009), it is something I love doing and I think I can speak on behalf of my co-presenters, when I say that they love it too.

Introduction to the workshop and why

Several years ago, a support provider for people with a learning disability experienced some difficulties around their support with money. They had received a warning notice from a regulator that they needed to remedy this situation urgently. My organisation (Dosh Ltd – Financial Advocacy at www.dosh.org) became part of the solution by delivering workshops across the country for their managers and leaders. This is something we quickly found we enjoyed and, from the feedback we received from delegates, were good at it too. Since then, we have been providing our training across England and Scotland. (Not yet in Wales or Northern Ireland, but never say never!)

What the workshop includes:

- Concepts and Values – the support options around money for people we support

- Mental Capacity Act (MCA) 2005 and Best Interest Decisions

- Financial Safeguarding

- State Benefits Awareness

- Introduction to Banking and Banking options for people with a learning disability

- Budgeting, Money Planning, and the Dosh ‘Money Plan Game’

- And a Q & A about supporting people to be more independent and have more control over their money.

Each delegate receives a Money Awareness Workbook which includes information and resources.

Related. Dosh – Play the game featured in our workshop is an interactive a game which was specifically designed for people with a learning disability. Delegates also have an opportunity to play the paper version during our day together.

Delivering training to a team in Sutton in Cambridgeshire

Five things we can do:

- We can customise our workshop to fit the needs of your colleagues. Recently in Scotland an organisation wished to have a focus on Banking; in another part of the country, we were asked to include a presentation on ‘Safeguarding’.

- We make our training accessible for the people attending our workshops. Dosh delivers training to people with a learning disability, support teams, their managers, social workers, and finance teams

- We can deliver workshops anywhere in England, Scotland, and Wales

- Share our workshop presentation in a pdf after our training so that candidates do not need to worry about note taking during the session.

- We provide a follow-up service after the workshop.

What the day involves:

Chocolate! Yes, you read it correctly. We have an activity that you can actually eat and when your energy is beginning to sap, we come to the rescue with a liberal sharing of sweets.

We spend time getting to know our delegates, especially during the activities and the breaks. We find out what worries and challenges them and about supporting people with their money.

Working alongside our delegates as the workshop progresses.

We use a range of media and training methods including videos, film, power point, flip chart, paper exercises and Q & A sessions.

Five things that make us different?

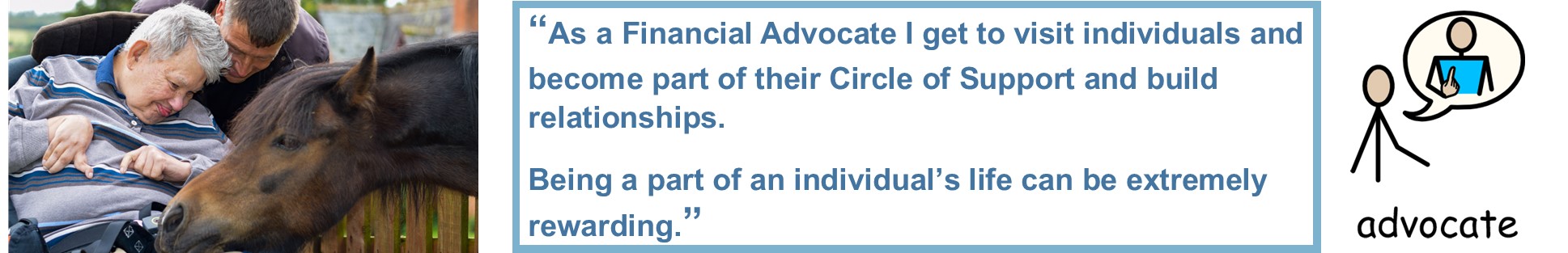

- Financial Advocates who deliver the training also support people daily with their money and state benefits to bank, budget, and plan.

- I am a parent/carer for a woman with a learning disability who copes with autism, so I bring a family member’s perspective to the table.

- We share stories and experiences from our ‘day to day work’ to illustrate our presentations.

- We do not stick rigidly to our programme – if the class wants us to focus on a particular area during the day, we can adjust our programme.

- Our support and training do not end when the workshop finishes as we share our contact details with delegates so they can continue to request information and answer questions they may have thought of after the training.

Feedback from our recent workshops

“Very Informative” “Enjoyable, learning” “Nice and friendly speakers” “Friendly, nice speakers, learning enjoyable” “Enjoyable, easy to understand and interact” “It was spot on” “Very good well presented” “Enjoyable” “Enjoyed the day” “Good action points to take away” “Very good training session very informative” “Very informative and fun” “Valuable information and sweeties”

The best thing about today was: “Gaining more confidence around supporting people with their money” “I will, apply this to my work in the future”

If you would like to hear more about our training and would like to book a workshop, here are some of, out contact details

Information about our training: https://www.dosh.org/training-and-workshops-for-your-group-or-organisation/

email: Angela and Kerry [email protected]

email me: [email protected]

Note: * Dosh is a not-for-profit company, supporting adults with a learning disability to have more control and independence with their money, since 2007.

Kerry Measures March 31st, 2023

Posted In: Banking, News and Blogs, Stories

How can I get support with Banking?

1. Tell the bank what support and changes you need to help you. Build up a relationship with your local bank, so that they know you and what you need.

2. Ask what reasonable adjustments they can make, for example, to help you take money out of your account easily. Ask what they can do for people with a disability.

3. Ask the bank staff to check with their specialist disability team. They can give staff extra support and information.

4. Ask about the different types of accounts they have.

Remember the important laws:

• The Equality Act says people with a disability must get equal access to banking

• The Mental Capacity Act helps people make their own decisions and explains how to check someone’s capacity.

• Banking laws on identity, data protection and clear information.

| With Capacity |

Without Capacity |

| Support (Reasonsable Adjustments) |

Appointee Account |

| Third Party Mandate |

Court of Protection – Single Decision |

| Joint Account |

Court of Protection – Deputy |

| Basic Bank Account |

Lasting Power of Attorney (If this was set up when you had capacity |

| Ordinary Power or Attorney |

| Lasting Power or Attorney |

|

These accounts are slightly different with each bank.

They may have different names and work in different ways. Ask each bank to tell you what they have

How to deal with problems?

1. Ask them to explain their decision and what else they can do to help you.

2. Ask if they have a disability or customer services team that can help them or that you can talk to.

3. Speak to the manager in the bank.

4. Speak to the bank’s head office.

5. Make a formal complaint to the bank.

6. Report the problem to the Financial Ombudsman Service or Financial Conduct Authority.

7. Contact the Equality Advisory and Support Service helpline, Disability Law Service or Citizens Advice Bureau.

8. Think about taking the bank to court.

Kerry Measures October 10th, 2022

Posted In: Banking, News and Blogs, Stories

In 2014, we created a report called Making Banking Easier. Our report highlighted some of the problems faced by people with a learning disability when banking.

It’s now 8 years since we published our report, and people with a learning disability still face many of the same challenges when banking. The advice we gave in the guide is still as important today as it was back then.

About Bank Accounts

Bank accounts are a way to look after and use your money through a bank or building society. Bank accounts are used for a lot of different things. You can put your money into your bank account, whether its from work or benefit payments. The money in your account can be used to pay bills and buy things you like. You can also keep money in your account to save for things for the future, like a holiday.

Banking

Banks can offer you a lot of different services. They can offer loans, mortgages and more. They also offer different types of bank account including Savings Accounts, Basic Bank Accounts, and Current Accounts.

If you have a bank account, your bank may write to you about the other services they offer. You should check carefully before you agree to anything new, and talk about any changes with a friend or advisor.

Getting a Bank account

You should be careful when signing up to a bank account or another banking service. You need to make sure you know what you are signing, how it will work, and how much it will cost you. Speak to someone you trust before you agree to anything with your bank.

Changing and closing your bank account

If you’re not happy with your bank account anymore, you should speak to your bank. They will be able to help you to close or change your account. It is easy to change or switch your bank account to one you would prefer. If you find an account you would like to switch to, speak to this bank who will help you switch from your old account.

Sometimes your bank will make a change to your account. If this happens, they will write to you to explain the changes they are making.

How can I get support with banking?

Whilst you don’t have to tell your bank about your disability, it can help if you tell them what adjustments and support you need. This could be physical if you require a wheelchair, or supporting you to understand the information the bank is giving you.

What should banks be doing?

- start by assuming that you have capacity.

- have different types of accessible information before you get a service (like advertising) and when you get the service (like in letters). They must tell you about these and make them available.

- support you to understand the information they give you.

- offer different ways of accessing a service and tell you about these. This should include internet and phone services.

- have branches that you can visit. Some banks have a branch near you, or let you use their services through the Post Office.

- accept different things as proof of identity. They can tell you what different things they accept as proof.

- judge someone’s capacity to make a decision by following the Mental Capacity Act, if they are worried or unsure about someone’s capacity.

- explain why they will not give you a service or how they have decided that you do not have capacity.

- aim to use the least restrictive option for people who lack capacity.

- offer each person the best access to banking for them. This could include different types of bank accounts that can be used with support if someone does not have the capacity to manage a bank account by themselves.

With Capacity

If you have the capacity to manage a bank account but still want some support, there are different things you can do, including:

Support from your bank: Banks can give you different types of support. For example, they can give you a chip and signature card, instead of a chip and PIN card. A PIN is a secret 4-digit number you usually have to remember to use your card.

They can give you information in different formats (like Easy Read) and they can explain things to you if they are hard to understand.

Third party mandate: You give another person temporary access to your bank account. The bank will have a form to let you do this.

Joint account: You share a bank account with another person and you both have full access to the money.

Basic bank account: You have your own bank account but it has some limits on what it can do. The details are different between the different banks.

They are for people with a low credit score, people that do not want an overdraft and people that want to limit how much they can spend and reduce the risks and costs of having a bank account.

Ordinary Power of Attorney: You give someone else control over all or part of your money and finances. This will stop if you lose capacity.

Lasting Power of Attorney for property and financial affairs: You give someone power over your money and finances when you still have capacity.

They can help you manage your money if you would like them to, even if you have capacity to do so yourself

Without capacity

Appointee account: Your appointee (the person or group that manages your benefits for you) has a separate account for your benefit money (like the Dosh Client Account).

Lasting Power of Attorney for property and financial affairs: You give someone power over your money and finances when you still have capacity.

Later, when you lose capacity to look after your own money, your attorney can step in and manage your money and property for you.

Court of Protection decision: This is usually for a one-off or single decision, for example the court decides to let someone else sign a tenancy agreement for a house for you.

Court of Protection Deputy for property and financial affairs: The court decides to appoint someone (your deputy) who can make decisions about your money for you, if you cannot make those decisions yourself.

Your deputy must work hard to support you to make decisions about your money yourself. The deputy must only step in and make a decision for you, if you cannot make that decision, even with lots of help and support.

If you are interested in these options, speak to your bank to find out what they can offer you. The details of each account will be different between banks and it is a good idea to ask what other options they offer.

Remember, make sure you understand all the information about any banking service before you sign up for it.

If you want more information about making legal changes like power of attorney or the Court of Protection, visit the gov.uk website

Edward Goater July 17th, 2022

Posted In: Banking, News and Blogs